Russia Rates Cut and GPB/USD Bullish Momentum

Published on: 09/9/19 10:10 AM

Tags: compare forex brokers, crypto trading, etorox, facebook, forex broker reviews, Forex News, forex trading, fxbrokerfeed

Category: Newsletter

The first week of September 2019 brightened the FX Market with favorable tariffs rhetoric that eased runaway risk aversion. Also, Bank of Russia instituted interest rates cut to prop up growth in the face of a global economic slow-down. Forex Broker comparison service FXBrokerFeed brings you the latest news and commentary in the FX Broker Market, featuring GPB/USD currency pair and Central Bank of Russia fiscal easing measures.

GPB/USD Bullish Rally

The currency pair took hint of favorable Brexit sentiment to witness an upward trend that chalked a 1.2300 intra-day high, and support at 1.2175, Thursday. The

bulls rallied with prospects of a Brexit deal after PM Johnson lost the House of Commons vote with no option but to negotiate with EU afresh.

Despite GPB posting the highest half year gain, the August inflation report cited slowing global economic growth, and BOE is expected to address parliamentarians regarding fiscal direction that bulwarks British business against creepy inflation and recession.

However, a court ruling confirming proroguing of parliament as legal pushed the pair down to 1.2295 on Friday but may still test a psychological 1.370 handle in the absence of “no deal” threats.

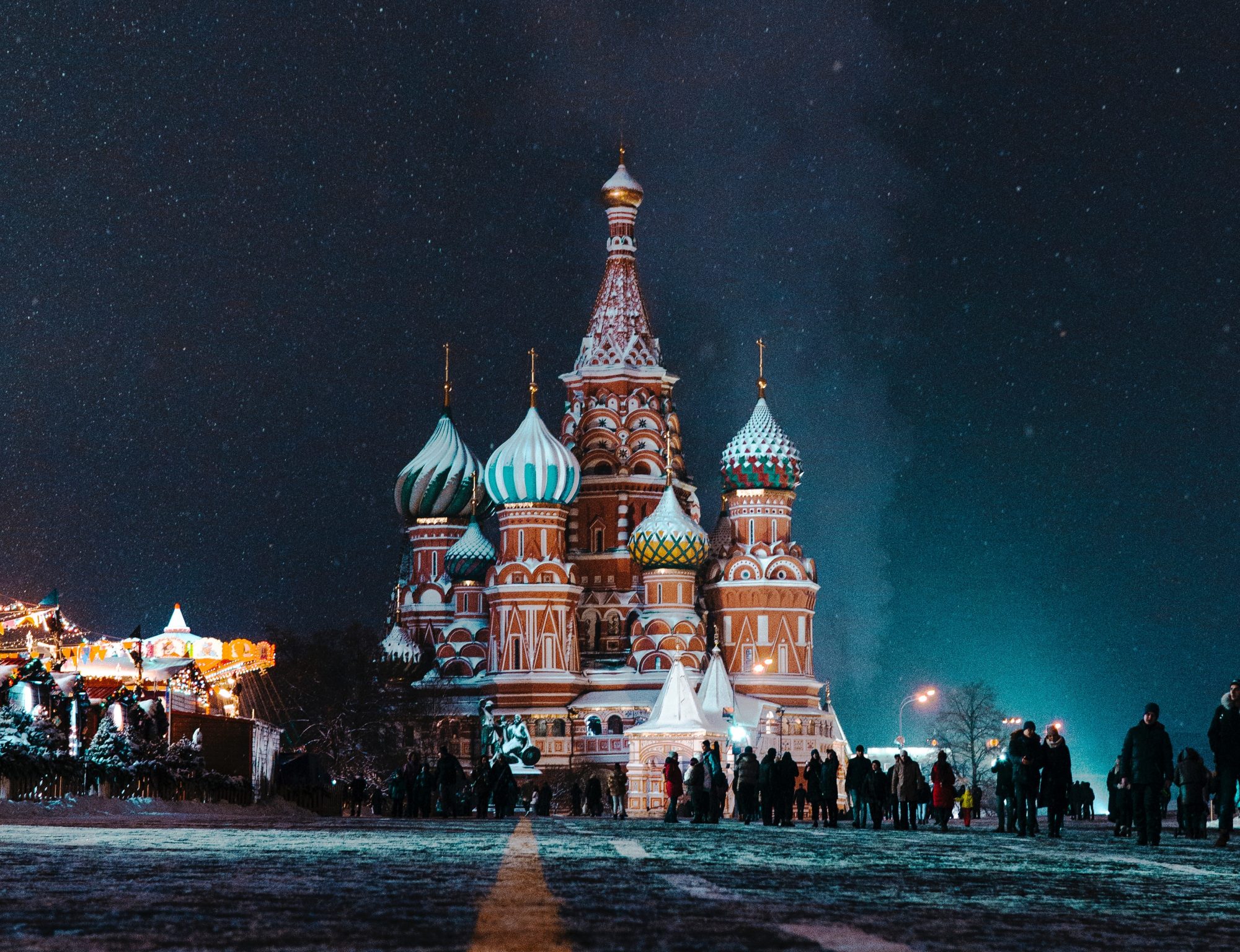

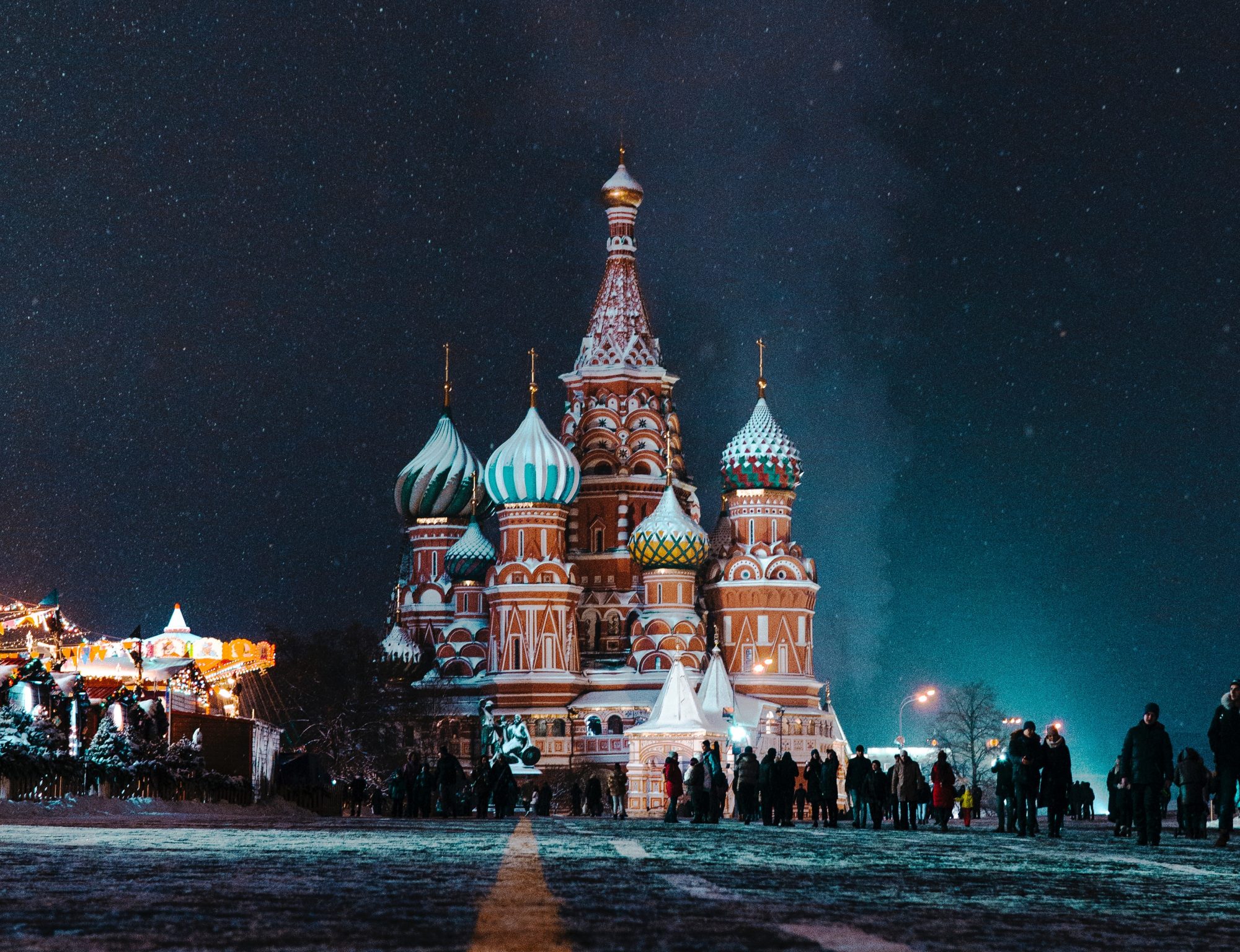

Bank of Russia Cuts Interest Rates

Bank of Russia Cuts Interest Rates

The Central Bank of Russia cut interest rates by 25 bps to 7% per annum to ease inflationary pressure, and mitigate seemingly imminent global recession. According to a Press Service report (cbr.ru) from the Bank of Russia,

annual inflation forecast for 2019 has been lowered from 4.2-4.7% to 4.0-4.5% with options for further rate cuts to absorb inflationary risks relative to the baseline forecast of 4.0%.

The report also depicts Russia’s low economic growth record for 2019, impact of US and Eurozone interest rate cuts, and geopolitical uncertainties as reason for the fiscal intervention. Additionally, slow implementation of projects by government, low disposable household incomes, and low external demand for industrial output were highlight contributory factors.

Today’s traders need a dependable way to navigate through the ever-changing world of Forex trading.

FXBrokerFeed brings to you relevant information about FX Brokers and currency pairs 24/7, and is an essential tool that will help improve your trading performance.

Start your 30-day free trial today!

Bank of Russia Cuts Interest Rates

Bank of Russia Cuts Interest Rates