Just when it looked like it was a game over situation for market bulls, along comes Monday’s less gloomy price action to kick off the trading week. Still, if it walks like a duck and talks like a duck, it may be best not to put all your eggs in one basket. As such, your plan of attack for stocks to trade should include long and short positions.

Let me explain.

Monday’s beefy rebound of 1.61% in the

SPDR S&P 500 ETF (NYSEARCA:

SPY) probably had a lot of investors distraught from last week saying or thinking loudly, “Bottom!” But you’ve been warned, don’t believe the hype or fake news when considering stocks to trade, as it could be a bear!

The abrupt change of heart by investors Monday is classic bear market behavior according to

CNBC’s front man Jim Cramer. But if you’re like me and appreciate Cramer’s well-intentioned warnings, then it’s likely a better time to simply trade.

Here are three stocks to trade long and short in-between the extremes of pessimism and optimism in a a tricky market, not one defined by simple bear or bull labels.

General Motors (GM)

The first of our stocks to trade is

General Motors (NYSE:

GM). GM stock had a big day Monday as shares zipped higher by nearly 5% through the 200-day simple moving average. The broader market’s own relief bid helped of course. However, GM had big news of its own to drive Wall Street into action.

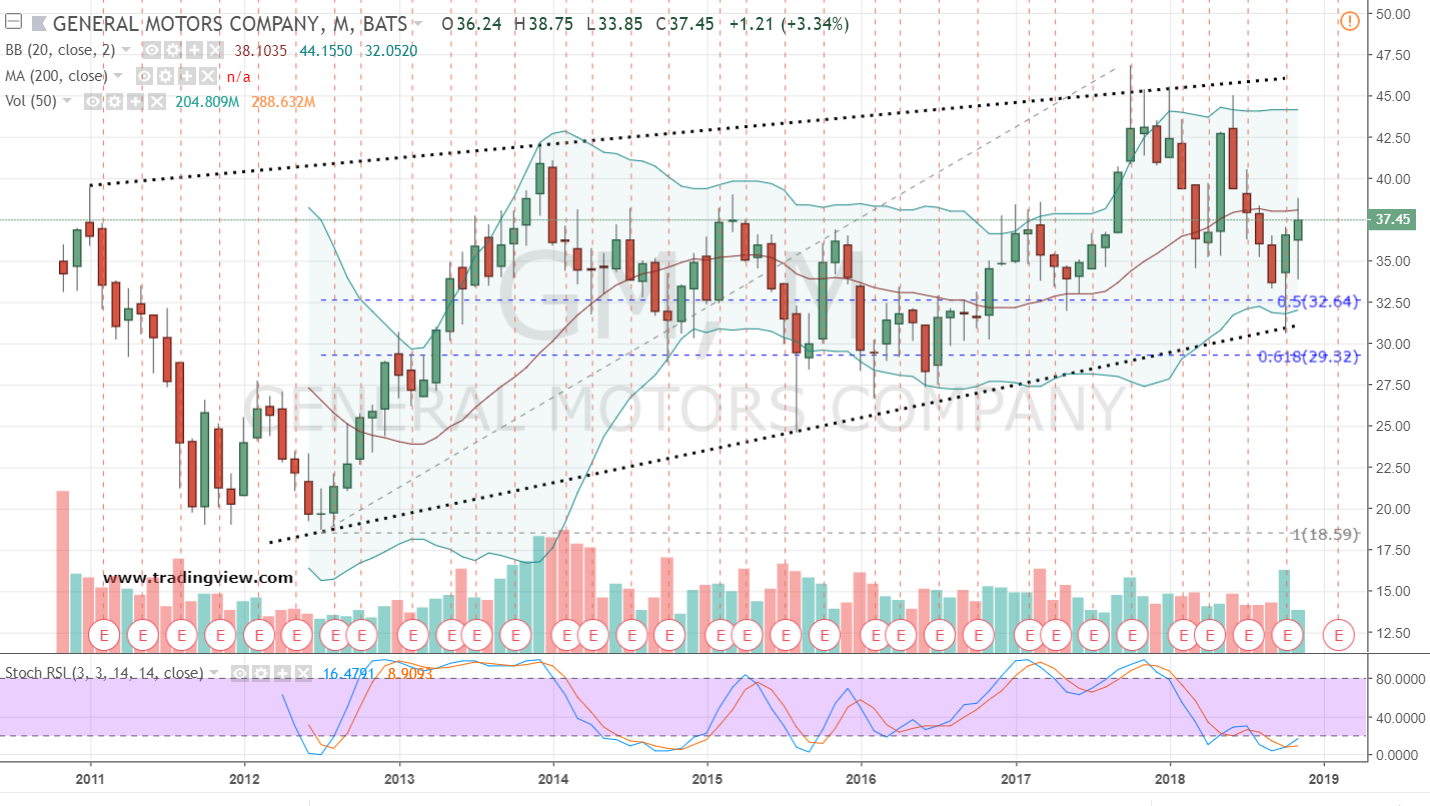

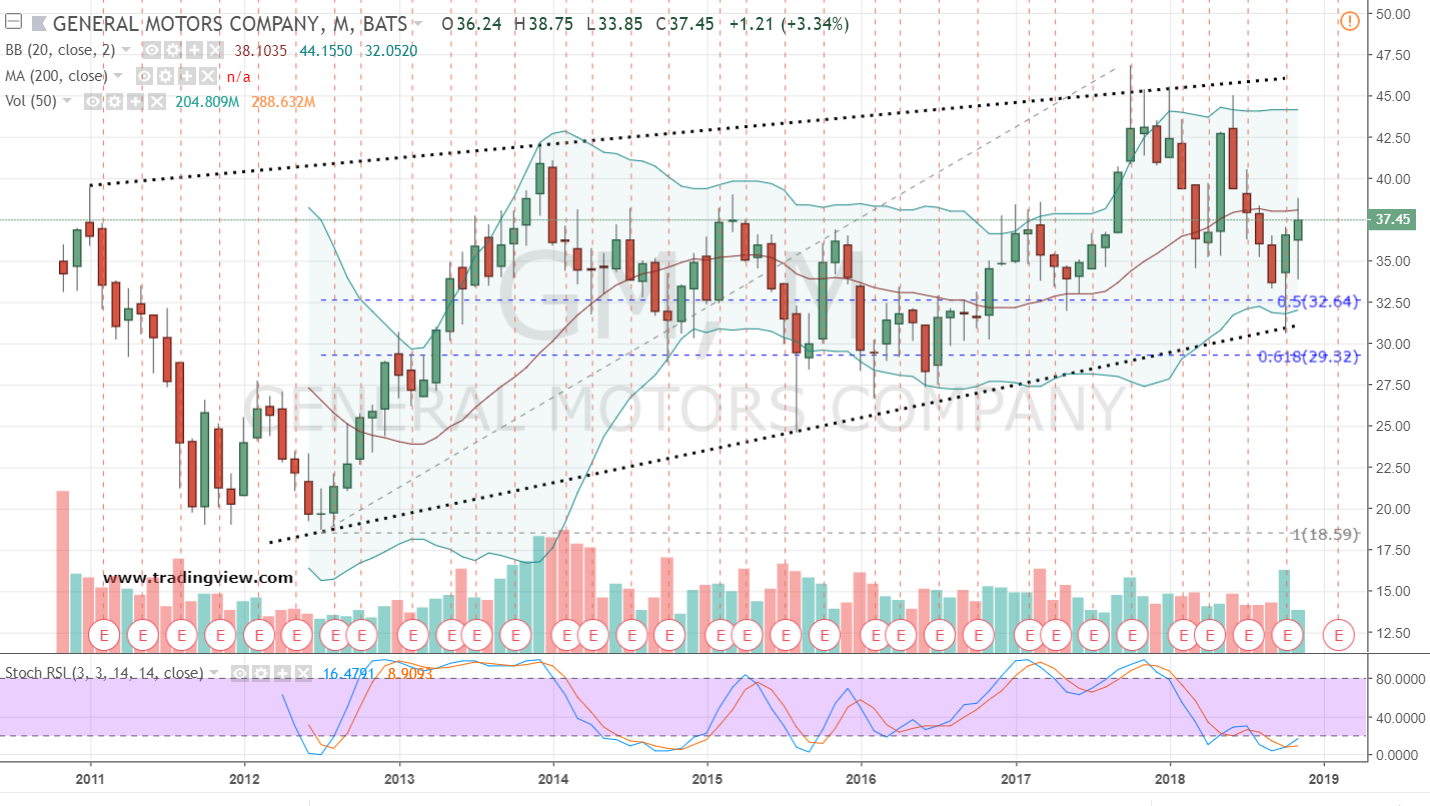

Monday’s big news for GM stock investors solely interested in bottom-lines rather than livelihoods was the auto giant’s plans for massive job cuts, shuddering plants as well as retooling and downsizing its automobile line-up. And whether you’re agreeable with Wall Street’s reaction, it’s even bigger and more bullish technical news on the monthly price chart of this stock to trade today.

The long-term view of GM stock shows Monday’s bid confirmed a massive hammer candlestick. With the bullish reversal pattern also confirming a new pivot low within General Motor’s uptrend and sporting an oversold stochastics crossover setup; GM is a stock to trade long.

The plan of attack in GM stock is to simply purchase shares and set a stop-loss 5% below current price levels. It’s a bit more than General Motors might typically deserve. However, in a volatile environment it makes sense. Furthermore, this stop will only be triggered below a trio of weekly chart doji “bodies.” That makes this an even smarter way to take a protected test drive with the potential for much larger profits in this stock to trade long.

Nvidia (NVDA)

The second of our stocks to trade is

Nvidia (NASDAQ:

NVDA). One of the market’s growth stock darlings the past couple years, shares of NVDA have taken it on the chin lately during the market’s correction. But as any seasoned momentum investor knows or should realize, that’s the dark and ugly side of this type of aggressive investing.

Sure, there has been plenty of excuses to fan NVDA stock’s fall from grace. There are trade war tensions that could prove disproportionately tough on tech companies like Nvidia, a burst cryptocurrency bubble and a recent spook-worthy earnings report to all but confirm the bulls’ narrative has imploded.

The good news is Wall Street has quickly put Nvidia shares deep into value territory for investors able to get past today’s latest and less-than-great story-line. The focus should now be on NVDA’s deep corrective move in a bearish market that’s overstaying its welcome.

The weekly chart shows NVDA stock is challenging zone support comprised of the 50% and 62% retracement levels dating back to 2015’s lows and immediately in front of the stock’s dizzying rally out of nowhere. But the dive in shares doesn’t necessarily mean Nvidia is one of those stocks to trade long and simply sit on.

Let’s face it, conditions could always quickly get painfully worse in NVDA stock, even if it’s just a figment of overly-bearish behavior. My recommendation is to buy shares above $157. The trigger price is roughly 1.5% above Tuesday’s high. It also allows Nvidia to re-cross the 50% retracement level and, optimistically, head back into a more spirited “glass half-full” mentality.

For money management and just in case the bears aren’t finished with NVDA stock, I’d set an initial stop 5% below $157 at $149.15. That’s slightly beneath Monday’s opening price. And if hit, that’s sufficient price information in an unstable market to exit and find other stocks to trade long without having suffered a large draw-down.

Caterpillar (CAT)

The last of our stocks to trade is

Caterpillar (NYSE:

CAT). But in CAT stock I have my eyes on lower prices and a short position. Let’s face it, maybe Cramer will be able to crow about his latest market call and it would be nice to have our long bets hedged with a worthy short. And Caterpillar fits the bill.

On top of sure signs the difficult business environment is already taking a toll on Caterpillar, shares of CAT stock are simply doing a lot of things correctly on the price chart … if you’re a bear! The weekly chart shows a good deal of potential supports ranging from Fibonacci to prior and cup high patterns being challenged.

Those lines could ultimately hold, but I’m not holding my breath.

Of these three stocks to trade, CAT is the only one in which shares have been trending and leading the market lower since topping in early 2018. CAT stock isn’t simply going along for the ride, it has been the ride, much to the delight of bears. So if market conditions are going to get even uglier and you’re looking for stocks to trade short, Caterpillar is looking very friendly.

More recently, Caterpillar shares have offered bearish traders a fresh lower high. With the reversal pattern confirmed a couple weeks ago but roughly 0.50% from an idealized entry beneath the shooting star or hangman low of $124.55, it’s not too late to short CAT today!

For like-minded traders up to the job of shorting CAT stock, I’d set a stop-loss on shares above $130. That works to contain losses to a small and manageable amount. That’s always smart business.

Furthermore, this stop exits the short if CAT rallies above the closing price of the confirmation candlestick from two weeks ago. Lastly, if Caterpillar scratches its way above $130 that also puts shares above all the formerly mentioned layers of potential support, which would look a good deal more meaningful to the bull case.

The first of our stocks to trade is General Motors (NYSE:GM). GM stock had a big day Monday as shares zipped higher by nearly 5% through the 200-day simple moving average. The broader market’s own relief bid helped of course. However, GM had big news of its own to drive Wall Street into action.

Monday’s big news for GM stock investors solely interested in bottom-lines rather than livelihoods was the auto giant’s plans for massive job cuts, shuddering plants as well as retooling and downsizing its automobile line-up. And whether you’re agreeable with Wall Street’s reaction, it’s even bigger and more bullish technical news on the monthly price chart of this stock to trade today.

The first of our stocks to trade is General Motors (NYSE:GM). GM stock had a big day Monday as shares zipped higher by nearly 5% through the 200-day simple moving average. The broader market’s own relief bid helped of course. However, GM had big news of its own to drive Wall Street into action.

Monday’s big news for GM stock investors solely interested in bottom-lines rather than livelihoods was the auto giant’s plans for massive job cuts, shuddering plants as well as retooling and downsizing its automobile line-up. And whether you’re agreeable with Wall Street’s reaction, it’s even bigger and more bullish technical news on the monthly price chart of this stock to trade today.

The long-term view of GM stock shows Monday’s bid confirmed a massive hammer candlestick. With the bullish reversal pattern also confirming a new pivot low within General Motor’s uptrend and sporting an oversold stochastics crossover setup; GM is a stock to trade long.

The plan of attack in GM stock is to simply purchase shares and set a stop-loss 5% below current price levels. It’s a bit more than General Motors might typically deserve. However, in a volatile environment it makes sense. Furthermore, this stop will only be triggered below a trio of weekly chart doji “bodies.” That makes this an even smarter way to take a protected test drive with the potential for much larger profits in this stock to trade long.

The long-term view of GM stock shows Monday’s bid confirmed a massive hammer candlestick. With the bullish reversal pattern also confirming a new pivot low within General Motor’s uptrend and sporting an oversold stochastics crossover setup; GM is a stock to trade long.

The plan of attack in GM stock is to simply purchase shares and set a stop-loss 5% below current price levels. It’s a bit more than General Motors might typically deserve. However, in a volatile environment it makes sense. Furthermore, this stop will only be triggered below a trio of weekly chart doji “bodies.” That makes this an even smarter way to take a protected test drive with the potential for much larger profits in this stock to trade long.

The second of our stocks to trade is Nvidia (NASDAQ:NVDA). One of the market’s growth stock darlings the past couple years, shares of NVDA have taken it on the chin lately during the market’s correction. But as any seasoned momentum investor knows or should realize, that’s the dark and ugly side of this type of aggressive investing.

Sure, there has been plenty of excuses to fan NVDA stock’s fall from grace. There are trade war tensions that could prove disproportionately tough on tech companies like Nvidia, a burst cryptocurrency bubble and a recent spook-worthy earnings report to all but confirm the bulls’ narrative has imploded.

The good news is Wall Street has quickly put Nvidia shares deep into value territory for investors able to get past today’s latest and less-than-great story-line. The focus should now be on NVDA’s deep corrective move in a bearish market that’s overstaying its welcome.

The weekly chart shows NVDA stock is challenging zone support comprised of the 50% and 62% retracement levels dating back to 2015’s lows and immediately in front of the stock’s dizzying rally out of nowhere. But the dive in shares doesn’t necessarily mean Nvidia is one of those stocks to trade long and simply sit on.

Let’s face it, conditions could always quickly get painfully worse in NVDA stock, even if it’s just a figment of overly-bearish behavior. My recommendation is to buy shares above $157. The trigger price is roughly 1.5% above Tuesday’s high. It also allows Nvidia to re-cross the 50% retracement level and, optimistically, head back into a more spirited “glass half-full” mentality.

For money management and just in case the bears aren’t finished with NVDA stock, I’d set an initial stop 5% below $157 at $149.15. That’s slightly beneath Monday’s opening price. And if hit, that’s sufficient price information in an unstable market to exit and find other stocks to trade long without having suffered a large draw-down.

The second of our stocks to trade is Nvidia (NASDAQ:NVDA). One of the market’s growth stock darlings the past couple years, shares of NVDA have taken it on the chin lately during the market’s correction. But as any seasoned momentum investor knows or should realize, that’s the dark and ugly side of this type of aggressive investing.

Sure, there has been plenty of excuses to fan NVDA stock’s fall from grace. There are trade war tensions that could prove disproportionately tough on tech companies like Nvidia, a burst cryptocurrency bubble and a recent spook-worthy earnings report to all but confirm the bulls’ narrative has imploded.

The good news is Wall Street has quickly put Nvidia shares deep into value territory for investors able to get past today’s latest and less-than-great story-line. The focus should now be on NVDA’s deep corrective move in a bearish market that’s overstaying its welcome.

The weekly chart shows NVDA stock is challenging zone support comprised of the 50% and 62% retracement levels dating back to 2015’s lows and immediately in front of the stock’s dizzying rally out of nowhere. But the dive in shares doesn’t necessarily mean Nvidia is one of those stocks to trade long and simply sit on.

Let’s face it, conditions could always quickly get painfully worse in NVDA stock, even if it’s just a figment of overly-bearish behavior. My recommendation is to buy shares above $157. The trigger price is roughly 1.5% above Tuesday’s high. It also allows Nvidia to re-cross the 50% retracement level and, optimistically, head back into a more spirited “glass half-full” mentality.

For money management and just in case the bears aren’t finished with NVDA stock, I’d set an initial stop 5% below $157 at $149.15. That’s slightly beneath Monday’s opening price. And if hit, that’s sufficient price information in an unstable market to exit and find other stocks to trade long without having suffered a large draw-down.

The last of our stocks to trade is Caterpillar (NYSE:CAT). But in CAT stock I have my eyes on lower prices and a short position. Let’s face it, maybe Cramer will be able to crow about his latest market call and it would be nice to have our long bets hedged with a worthy short. And Caterpillar fits the bill.

On top of sure signs the difficult business environment is already taking a toll on Caterpillar, shares of CAT stock are simply doing a lot of things correctly on the price chart … if you’re a bear! The weekly chart shows a good deal of potential supports ranging from Fibonacci to prior and cup high patterns being challenged.

The last of our stocks to trade is Caterpillar (NYSE:CAT). But in CAT stock I have my eyes on lower prices and a short position. Let’s face it, maybe Cramer will be able to crow about his latest market call and it would be nice to have our long bets hedged with a worthy short. And Caterpillar fits the bill.

On top of sure signs the difficult business environment is already taking a toll on Caterpillar, shares of CAT stock are simply doing a lot of things correctly on the price chart … if you’re a bear! The weekly chart shows a good deal of potential supports ranging from Fibonacci to prior and cup high patterns being challenged.